Mastering Trading Psychology: Emotional Triggers

Master Your Mind for Market Success - Part 1 of 4

Trading isn't just numbers and charts—it's a mental battlefield. Emotional triggers like fear, greed, and overconfidence can sabotage even the best strategies. In this opening article, we'll uncover what drives these emotions, how market conditions amplify them, and how to spot them before they cost you. With real trader stories, neuroscience insights, and NinjaTrader tools, you'll gain the awareness to take control. Let's master your mind, one trigger at a time.

Unpacking Emotional Triggers

Emotions aren't random—they're wired into your brain and sparked by the market. Here's what sets them off:

Market Conditions

High-volatility days (e.g., NFP releases) or news shocks (e.g., 2020 COVID crash) spike adrenaline—Trader John lost 20% chasing a rumor-driven ES spike in 2023.

Neuroscience of Trading

Fear activates your amygdala, clouding logic—greed floods dopamine, pushing rash bets. It's biology, not weakness.

Common Biases

Recency bias (overreacting to recent losses) and sunk cost fallacy (holding losers too long) trap traders daily.

NinjaTrader Tip: Set ATR alerts to flag volatile moments—pause when emotions run hot.

What's Your Trigger? A Quick Quiz

Answer these 5 questions to uncover your emotional weak spots:

- 1. Do you trade more after a big win? (Overconfidence)

- 2. Do you hold losers hoping they'll recover? (Sunk Cost)

- 3. Do you panic-sell after a sudden drop? (Fear)

- 4. Do you chase moves after missing out? (FOMO)

- 5. Do you ignore your plan during news events? (Impulse)

Score: 3+ “Yes” answers? Emotions may be driving your trades.

Use NinjaTrader's journal to log your quiz results and track patterns.

Triggers in Action

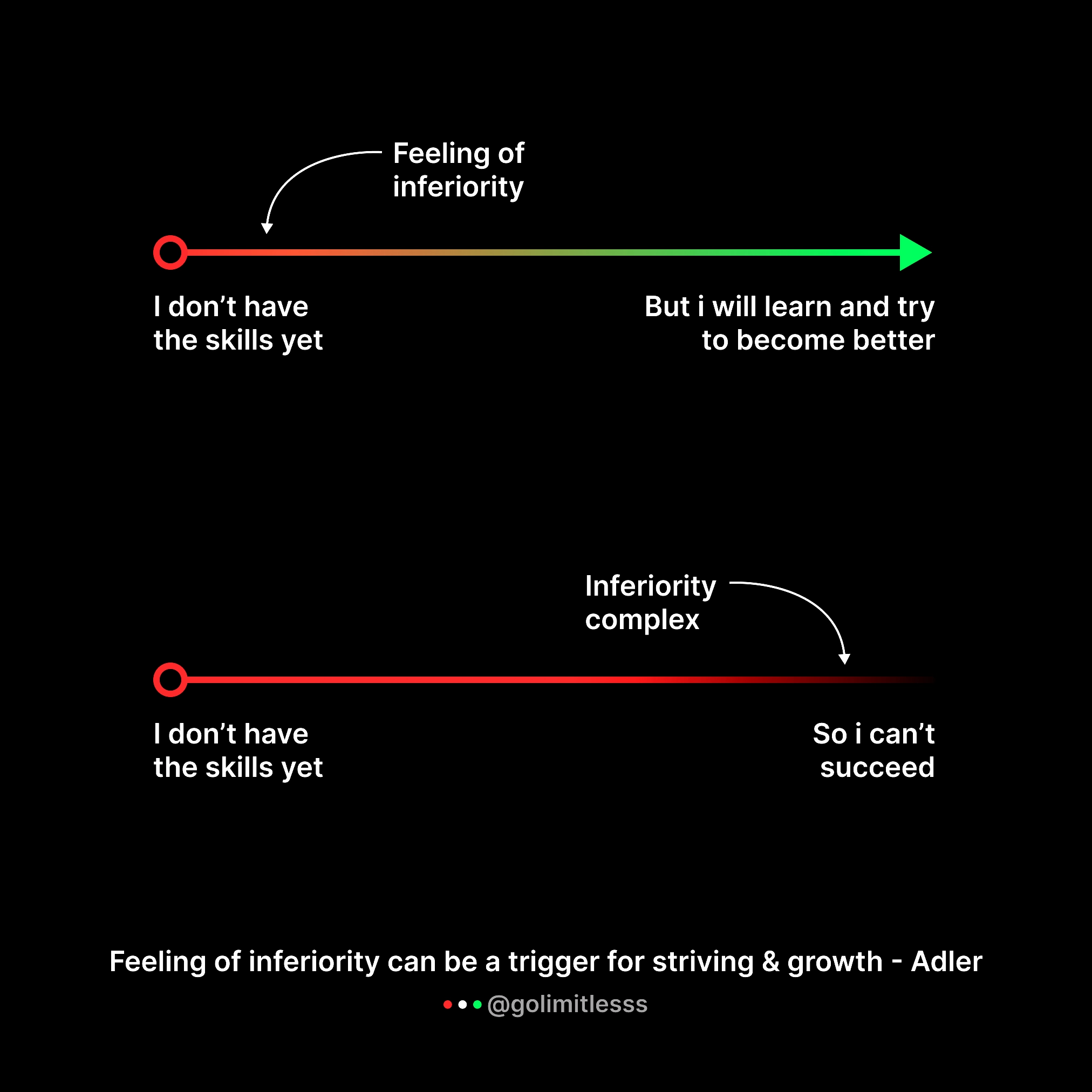

See how the feeling of inferiority skews trading results:

Source: @golimitlesss

After a loss, inferiority can trigger growth (“I'll learn”) or a complex (“I can't succeed”). Use NinjaTrader's journal to reframe setbacks and build a stronger mindset over time.

Conceptual Takeaways

- Emotions spike in volatile markets—watch news and ATR.

- Your brain drives fear and greed—know the science.

- Spot triggers with self-awareness—start journaling today.

Next, we'll build the discipline to tame these triggers.

Timeline: Day 1: Take the quiz. Week 1: Log 5 trades' emotions.

Emotional Emergency: 60-Second Reset

Heart racing mid-trade? Breathe deeply, check NinjaTrader's ATR, step away. Regain control fast.

“Fear and greed are the market's puppet strings—cut them.” — Jesse Livermore

Ready to Build Discipline?

Continue with Part 2: Discipline Foundations.

Enhance Your Trading with Pro Tools

Simplify psychology with NinjaTrader 8 tools like alerts and playback. Pair them with our knowledgebase for a sharper mental edge.

Explore the Indicators